High-Barrier Paper Bag Market Trends and Size 2026-35

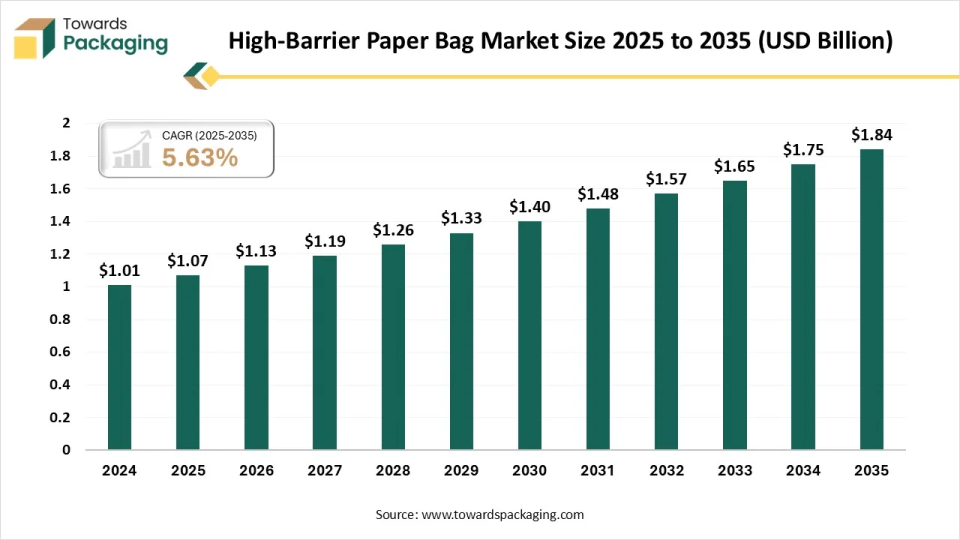

As highlighted by Towards Packaging research, the global high-barrier paper bag market, valued at USD 1.07 billion in 2025, is expected to reach USD 1.84 billion by 2035, registering a CAGR of 5.63% throughout the forecast period.

Ottawa, Feb. 10, 2026 (GLOBE NEWSWIRE) -- The global high-barrier paper bag market reported a value of USD 1.07 billion in 2025, and according to estimates, it will reach USD 1.84 billion by 2035, as outlined in a study from Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is a High-Barrier Paper Bag?

The high-barrier paper bag market refers to the industry producing sustainable, paper-based packaging designed to protect contents from oxygen, moisture, light, and grease, offering a recyclable alternative to plastic. These bags use advanced coatings, laminates, or multi-layered structures to maintain product freshness and shelf life in food, pharmaceuticals, and industrial applications.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5940

Private Industry Investments for High-Barrier Paper Bags

- Mondi Group (€16 Million): Mondi invested in new technology at its Solec plant in Poland to produce "FunctionalBarrier Paper Ultimate," a recyclable solution offering ultra-high protection against oxygen and moisture for food products.

- Tetra Pak (€60 Million): The company is funding a new pilot plant in Lund, Sweden, to accelerate the development of a paper-based barrier that replaces traditional aluminium foil in aseptic beverage cartons.

- Sappi North America ($500 Million): Through "Project Elevate," Sappi converted and expanded its Somerset Mill in Maine to become a leading advanced production site for high-performance, sustainable paperboard used in food and consumer packaging.

- Smurfit Kappa ($40 Million): This regional investment package in Latin America included $9.5 million for a new paper sack machine in Colombia to increase capacity for multi-ply, high-performance bags.

-

Billerud ($127 Million): Billerud is upgrading its Michigan facilities to transition from graphic paper to high-quality paperboard production, targeting the growing North American primary fiber packaging market.g

What Are the Latest Key Trends in the High-Barrier Paper Bag Market?

- Eco-Friendly Barrier Innovations: Manufacturers are adopting plant-based or water-based coatings to provide moisture and grease resistance without sacrificing recyclability, expanding paper usage into new areas like frozen food.

- Sustainability Drives Demand: The market is heavily influenced by plastic bans and consumer preference for compostable, biodegradable packaging solutions.

-

High-Barrier Technology: Development of nano-cellulose and advanced coatings aims to replicate the protective barrier properties of plastic, such as oxygen and aroma barriers, while staying within the paper stream.

What Is the Potential Growth Rate of the High-Barrier Paper Bag Industry?

The high-barrier paper bag industry is experiencing robust growth, with specialized high-barrier paper, driven by demand for sustainable, protective packaging. The shift is fueled by increasing, strict government regulations on single-use plastics and consumer demand for eco-friendly alternatives. The food, retail, and e-commerce industries are major adopters of these, particularly with increased demand for high-performance, sustainable packaging solutions.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Regional Analysis:

Who is the leader in the High-Barrier Paper Bag Market?

North America has dominated the global market by holding the highest share of 45.5% in 2025, due to rising regulatory pressure against single-use plastics and growing demand for sustainable packaging in food, pet food, and specialty consumer goods. Brands are shifting toward fiber-based solutions that provide moisture, oxygen, and grease resistance while maintaining recyclability. Advanced converting technologies, high consumer awareness of eco-friendly packaging, and strong retail sustainability commitments are accelerating adoption across grocery, food service, and e-commerce packaging applications.

Canada High-Barrier Paper Bag Market Growth Trends

Canada leads regional demand driven by strict state-level plastic reduction laws, strong growth in packaged food consumption, and retailer commitments to recyclable and compostable packaging. Innovation in water-based barrier coatings and fiber-based laminates further supports market expansion, especially as companies aim to balance performance with sustainability goals.

How did Asia Pacific Expect to Experience Growth in the High-Barrier Paper Bag Industry?

Asia Pacific is expected to experience growth in the market in the forecast period, driven by urbanization, rising packaged food demand, and sustainability awareness across emerging and developed economies. Growth in quick-service restaurants, online grocery, and premium food packaging supports wider adoption of high-performance paper-based packaging solutions.

India High-Barrier Paper Bag Market Trends

India leads regional momentum due to tightening regulations on plastic waste and strong growth in food, beverage, and e-commerce packaging. Domestic manufacturers are investing in barrier coating technologies and fiber-based packaging innovations to meet sustainability goals. As Indian brands target export markets with stricter environmental standards, demand for high-barrier paper bags with enhanced functional performance continues to increase.

More Insights of Towards Packaging:

- Packaging Films Market Size and Segments Outlook (2026–2035)

- Contract Packaging and Fulfilment Services Market Size, Trends and Regional Analysis (2026–2035)

- Canada Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- South Korea Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Germany Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- U.S. Glass Packaging Market Size and Segments Outlook (2026–2035)

- Flexible Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

- France Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Japan Packaging Machinery Market Size, Trends and Competitive Landscape (2026–2035)

- Repackaging Service Market Size and Segments Outlook (2026–2035)

- Corrugated Automotive Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Barrier-Coated Flexible Paper Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Bio-Based Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Active and Intelligent Packaging Market Size and Segments Outlook (2026–2035)

- Plain Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Waste Management Market Size, Trends and Competitive Landscape (2026–2035)

- Track and Trace Packaging Market Size, Trends and Segments (2026–2035)

- Single-Use Plastic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

Segment Outlook

Product Type Insight

Which Product Type Segment Dominates the High-Barrier Paper Bag Market?

The paper bags with barrier coatings segment dominated the market with a share of 52.3% in 2025, as they are gaining strong adoption as sustainable alternatives to plastic-based flexible packaging. Growth is driven by regulatory pressure to reduce plastic use, particularly in food and dry goods packaging. Advances in water-based and bio-based barrier coatings further enhance performance while aligning with sustainability goals across global packaging industries.

The laminated barrier paper bags segment is projected to grow at the fastest rate in the market in the forecast period, as it offers enhanced protection by combining paper with polymer or foil layers to achieve superior moisture and oxygen barrier properties. They are widely used in packaging products requiring extended shelf life, such as pet food, powdered foods, chemicals, and pharmaceutical intermediates. Innovation in mono-material laminates and recyclable barrier films is improving sustainability. Demand is increasing in industrial and high-value food packaging segments requiring robust protective performance.

Material Insight

How did Kraft Paper Segment Dominate the High-Barrier Paper Bag Market?

The kraft paper segment dominated the market with a share of 52.4% in 2025, due to its strength, durability, and natural appeal. It provides excellent printability and structural integrity for heavy and medium-weight packaging applications. Growth is supported by rising consumer preference for eco-friendly packaging and the food industry’s shift toward paper-based solutions. When combined with barrier layers, kraft paper enables manufacturers to balance sustainability with functional performance.

The speciality barrier paper segment is projected to grow at the fastest rate in the market in the forecast period, as they are engineered with integrated functional layers that deliver moisture, grease, and oxygen resistance without relying heavily on plastic laminates. Technological advancements in fiber treatment and coating processes are enabling improved performance while maintaining compostability and recyclability, making specialty barrier papers a fast-growing material segment.

End Use Industry Insight

Which End Use Industry Segment Dominates the High-Barrier Paper Bag Market?

The food and beverage segment dominated the market with a share of 40.9% in 2025, driven by the need to protect products such as flour, sugar, coffee, snacks, pet food, and ready-to-eat items. Barrier paper bags help extend shelf life while supporting brand sustainability commitments, making them increasingly preferred in dry and semi-dry food packaging applications.

The pharmaceutical and healthcare segment is projected to grow at the fastest rate in the market in the forecast period, due to applications requiring high-barrier paper bags for packaging powders, medical supplies, and active ingredients that demand protection from moisture and contamination. As sustainability initiatives expand in the healthcare sector, manufacturers are developing recyclable and compliant paper-based barrier packaging, supporting steady growth in this specialized end-use segment.

Distribution Channel Insight

How Did the B2B Segment Dominate the High-Barrier Paper Bag Market?

The B2B segment dominated the market with a share of 67.7% in 2025, as manufacturers supply high-barrier paper bags directly to food processors, pharmaceutical companies, and industrial packaging users. Long-term contracts, bulk procurement, and customized packaging specifications characterize this channel. Distributors and converters also play a key role in value-added services such as printing, lamination, and format customization, supporting efficient supply chain integration across industries.

The B2C segment is projected to grow at the fastest rate in the market in the forecast period, particularly through retail packaging and e-commerce-driven direct sales of sustainable packaging solutions. Small food brands, specialty stores, and eco-conscious businesses are adopting high-barrier paper bags for branded retail packaging. Online platforms are enabling easier access to customized small-batch packaging, contributing to gradual growth in the B2C segment, especially in premium and artisanal product categories.

Recent Breakthroughs in the High-Barrier Paper Bag Industry

In January 2026, ePac Flexible Packaging launched new easy-open, high-barrier films for coffee bags, aiming to improve convenience and the consumer experience. This film technology provides strong product protection while allowing bags to be opened easily without tools.

In September 2025, Sappi Europe introduced two new recyclable, mono-material high-barrier packaging papers, Guard Pro OHS and Guard Pro OMH. The papers are designed as alternatives to plastic and multi-layer foils in primary packaging.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Companies in the High-Barrier Paper Bag Market & Their Offerings:

- Fres-co System: Offers high-performance industrial and powder bags with near-zero moisture and oxygen transmission rates, designed as a superior alternative to standard kraft bags.

- Dura Pack: Provides reinforced paper shipping bags (Dura-Bag) made from kraft paper and fiberglass for ultra-strong, water-resistant protection during transport.

- Clifton Packaging Group: Manufactures high-barrier paper pouches and films that provide medium-to-high barrier protection for food safety and prolonged shelf life.

- Bernhardt Packaging & Process: Specialises in multi-layer high-barrier bags that combine paper with aluminium or EVOH to protect pharmaceutical and chemical products from oxidation and UV rays.

- Bischof + Klein: Produces technical high-barrier paper-based laminates and bags for the food and industrial sectors, focusing on sustainable protective materials.

- Bemis Company Inc. (Now part of Amcor): Developed advanced high-barrier paper structures for medical and food applications prior to its merger with Amcor.

- Sonoco Products Company: Offers high-barrier paper-based flexible packaging solutions that provide protective properties for consumer goods and industrial applications.

- Sealed Air Corporation: Features high-barrier paper packaging under its protective and food safety brands to reduce environmental impact while maintaining product integrity.

- Amcor Plc: Provides a wide range of high-barrier paper-based packaging solutions, including recyclable paper pouches designed to replace traditional plastic barriers.

- Mondi Group: Offers the FunctionalBarrier Paper and PaperPlus ranges, providing high and very high-barrier paper-based solutions for humidity-sensitive products.

Segment Covered in the Report

By Product Type

- Paper Bags with Barrier Coating

- Water-based barrier–coated paper bags

- Bio-based coated paper bags

- Grease- and moisture-resistant coated bags

- Multi-wall Barrier Paper Bags

- Two-ply multi-wall bags

- Three-ply multi-wall bags

- Valve-type multi-wall bags

- Laminated Barrier Paper Bags

- Paper–aluminum laminate bags

- Paper–biofilm laminate bags

- Paper–plastic-free laminate bags

By Material

- Kraft Paper

- Virgin Kraft paper

- Bleached kraft paper

- Unbleached kraft paper

- Recycled Paper

- Post-consumer recycled paper

- Post-industrial recycled paper

- Specialty Barrier Paper

- High-grease-resistance paper

- Oxygen & moisture barrier paper

- Compostable specialty barrier paper

By End-Use Industry

- Food & Beverages

- Dry food packaging (grains, flour, sugar)

- Bakery & confectionery

- Coffee & tea packaging

- Pharmaceuticals & Healthcare

- Medical device packaging

- Pharmaceutical raw material bags

- Hygienic healthcare packaging

- Retail & E-Commerce

- Sustainable shopping bags

- E-commerce shipment bags

- Industrial & Chemicals

- Cement & construction materials

- Specialty chemicals

- Agricultural inputs

- Personal Care & Cosmetics

- Powder-based cosmetics

- Soap & hygiene product packaging

By Distribution Channel

- B2B

- Direct manufacturer-to-brand sales

- Industrial bulk supply contracts

- B2C

- Online direct-to-consumer sales

- Retail distribution

By Region

-

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

-

South America:

- Brazil

- Argentina

- Rest of South America

-

Europe:

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

-

Western Europe

-

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

-

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

-

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5940

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- Middle East Seafood Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Middle East Packaging Machinery Market Size, Trends and Segments (2026–2035)

- Biofoam Packaging Market Size and Segments Outlook (2026–2035)

- Sanitary Food and Beverage Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Ready-to-Use Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Size, Trends and Competitive Landscape (2026–2035)

- Asia Pacific Food Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Europe Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- North America Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- North America Post-Consumer Recycled Plastics Food Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Transfer Molded Pulp Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Food Packaging Market Size and Segments Outlook (2026–2035)

- Shrink Label Films Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Rigid Packaging Market Size, Trends and Segments (2026–2035)

- North America Packaging Market Size, Trends and Regional Analysis (2026–2035)

- North America Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Biopolymer Packaging Market Size, Trends and Segments (2026–2035)

- Next-Generation Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Recycled Materials Packaging Solutions Market Size and Segments Outlook (2026–2035)

- Commercial Printing Market Size, Trends and Competitive Landscape (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.